S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Jun, 2025

By Brian Scheid

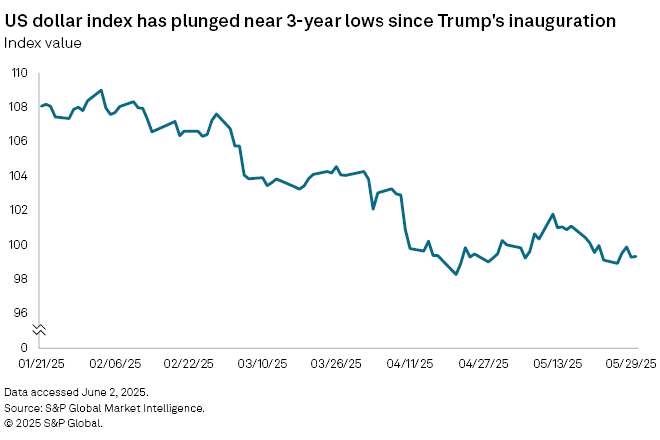

Ongoing uncertainty about US trade policy has become a dominant theme in financial markets, triggering a bond market sell-off, pushing stocks off their highs and sending the US dollar to its lowest level in years amid back-and-forth on tariffs on US imports.

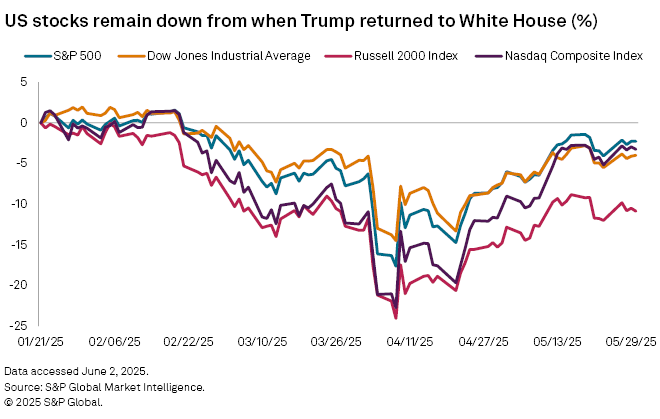

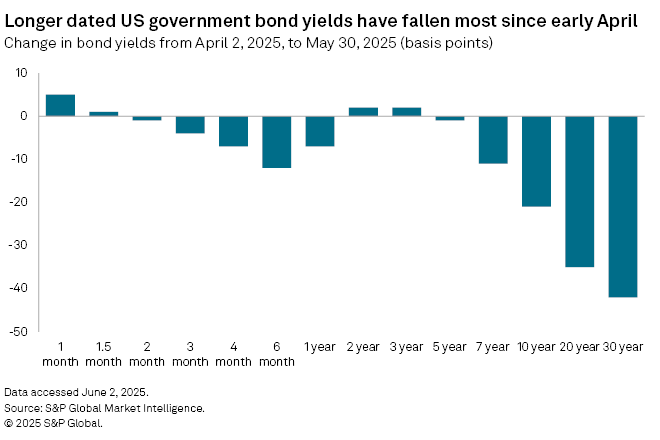

The S&P 500 remains more than 2% below its level on Jan. 21 — Inauguration Day — with other major indexes further lagging their late-January heights. The benchmark 10-year US Treasury yield, which moves opposite the bond's price, has jumped more than 40 basis points since its April low, while the longer-dated 30-year yield has jumped nearly 60 basis points and the dollar has dropped more than 8% since Jan. 21.

Investors view the lack of concrete details and an unclear policy road map as obstacles to their trading strategies, following President Donald Trump's announcement of tariffs on trading partners, pauses in their implementation and discussions of potential trade deals. A run of recent court rulings on the tariffs' legality has also increased uncertainty over whether they will ultimately stick.

"We're back to trade dominating headlines after a month of reprieve in May where attention was able to shift back to AI and other fundamental themes," said Lara Castleton, US head of portfolio construction and strategy at Janus Henderson Investors.

Stocks initially cratered in April following Trump's announcement of tariffs on nearly all global trading partners, but have mostly recovered as implementation was paused. Any rally in equities, however, will be constrained by the possibility of new, higher tariffs and possibility of further changes to the flow of global goods, according to investment analysts and economists.

"Tariffs create their own headaches for investors, businesses and consumers, but the uncertainty around tariffs has an impact too," said Bret Kenwell, a US investment and options analyst at eToro.

The ongoing uncertainty engulfing US policy appears to be weighing on the markets and the broader economy more than any specifics about the tariffs themselves at this point, said James Egelhof, chief US economist with BNP Paribas.

"We see uncertainty as being the key factor," Egelhof said.

So far, businesses have focused on building inventories to prepare for a period of elevated tariffs. More permanent economic effects, such as widespread layoffs or significant pullbacks in investment, have yet to take root, Egelhof said. While bonds and stocks have sold off and the dollar has continued to decline, there has not been a substantial move by investors to reallocate their portfolios, Egelhof noted.

"This all lines up with the view that investors are confident and businesses are confident that the tariff uncertainty will abate and that a recession will be avoided," Egelhof said.

The next major moves in markets likely will be determined by whether the domestic economy can hold up to tariff threats and policy volatility, said Tom Essaye, founder of Sevens Report Research. The Federal Reserve looks likely to keep rates at current levels until late this year, Essaye said.

Trump may not follow through on tariff threats, but "the tariff burden has still increased and that uncertainty continues to warrant keeping long exposure but reducing volatility, at least in my view," Essaye said.

While investors face risks amid potential escalation with major US trading partners, they also could start to gain confidence as preliminary trade resolutions and court rulings take shape, said Kenwell with eToro.

"Even if the tariff impacts — both tangible and intangible — are short-lived, investors will need to see evidence that the consumer remains strong and earnings growth is reaccelerating for them to remain in a risk-on state," Kenwell said.